How to receive money in a cryptocurrency pricing bitcoin velocity of money supply

The weakness of fractional-reserve banking is that it relies heavily on the assumption that not everybody will need to access all their money at the same time, and thus trust in the. Events Upcoming Past. For instance, people may hold Bitcoin because they anticipate on it to eventually become global money. Governments will do everything possible to maintain the monopoly of the creation of money This is a common argument against Bitcoin, credible, and relevant to the future acceptance of Bitcoin in the world, and therefore to its valuation. Sign Up for Alerts. The upper bound estimate of 3. But population does work well to estimate acceptance of many currencies. According to the above estimation, we are going to assume that there are 87 million people who accept Bitcoin as a means of payment, and below we will see how Bitcoin ranks in a world currency ranking according to its number of users. I believe that any economist will recognize that the price of an asset in a liquid market as in the case of Bitcoin is at least a good approximation to its value. Enter your information to receive the full report. Well, this phrase summarises the Subjective Theory of Value which is a well known economic gwei to ethereum European ethereum exchange, shared by many bitcoin supply historical buy groceries with bitcoin economists and one of the most important principles of the increasingly influential Austrian School of Economics. Thanks to Ryan Youngjoon Yi. Never miss buy bitcoin with amazon gift card ecode previous bitcoin forks story from Icofundingwhen you sign up for Medium. Also, I briefed the Minneapolis Fed Board of Directors on economic conditions and the effects of monetary policy. By using a form of money to when did bitcoin get popular ethereum canvas value, specialization of labor became possible. However, new money although technically; credit also starts to circulate in the economy due to fractional-reserve bankingwhich is the norm for most banking systems throughout the world. We then make assumptions that inactivity for a period of time suggests the wallet is lost. Also, some of the countries represented share a currency as in the case of the euro. Therefore, it states adoption of blockchain protocols will increase the demand for these tokens, thus increasing their value. Let us know in the comments below! Several European countries Greece, Portugal, Spain, Ireland and Cyprus were not able to refinance their governance debt or bail out over-indebted banks that were in trouble due to a bank run. However, USD does not appear coinbase does not show ethereum how do deposit money into bitfinex on the right hand side of 7. All Rights Reserved.

What gives cryptocurrencies value?

Recieve our weekly research updates. BCH Bitcoin Cash I am not saying that the story of the pizza never happened, but that this is not the reality with which the Bitcoin users find today. Anecdotally, we know this occurs. Estimating the size of the Bitcoin economy is not easy. Bitcoin is money, the argument is how good a form of money. This means that all bitcoin transactions are public and traceable, what happens is that they are coded so that only those who know who controls the addresses involved in a trade can know who are the parties to a specific transaction. The Rundown. Sign delete bitstamp account coinmama insert your identification document number Get started. Bitcoin was the first cryptocurrency that drew widespread attention. Learn. These discussions normally focused on the premises of cryptocurrency, and numbers were relegated to a secondary position and back-of-the-envelope calculations. Latest Top 2.

This approach takes M , Q , and V as given. While explaining all differences between cryptocurrencies is beyond the scope of this article, two economic theories that have emerged due to the evolution of cryptocurrencies will be discussed. Bitcoin price analysis shows that BTC has managed to When 6 is written in terms of the units on the two sides of the equation, one obtains:. The answer to that question depends on which economic theory you adopt. The second correct application of the Quantity Theory of Tokens is to rewrite 1 as:. For 6 to be a correct specification, the units on both sides of the equation have to be the same as is the case with 1. The choice of as the boundary for lost bitcoin is a judgement based on our analysis of the cohorts of bitcoin holders over time. Therefore, the creation of only a small amount of new money by a central bank or amount of money added to a savings account can result in much larger amount of money being added to the circulation within an economy. That is to say, Bitcoin has come to be what is today assuming at the same time that it represents a certain threat to the central banks of the world. This phenomenon is known as a bank run. It believes that the costs of production are also determined by subjective factors based on value of alternative uses of scarce resources and that the equilibrium of demand and supply is also determined by individual preferences. This decline in velocity in so far is due to an increase in short term speculators and a decline in transaction volumes. Due to banks lending some people more money than they should to buy houses that were already overpriced, the delinquency rates rapidly increased. My research focus primarily has been money and banking theory and history, and the relationship between money growth and inflation. This has been the case for a range of reasons, but the fact is that there are signals that some of them are studying it seriously. To prevent entire countries from going bankrupt, destabilizing the European Union EU , the EU and European Central Bank stepped up as a lender of last resort and unrolled multiple emergency measures. As of April , of the 21 million bitcoin that will ever exist, around 4 million are currently unmined, at least 2.

Key findings

The average velocity from January to April has fallen to 8. I ignore such costs here as they are not relevant for this discussion. Download the Full Research Report Please provide your information in order to access the full report. In the table below you can see Bitcoin in a ranking of countries according to their published M3 money supply. Applying this to the project economy yields:. The Austrian school emphasizes the importance of scarcity and the avoidance of governmental interference. Bulls Rejoice as Ascending Triangle Support The average age of a cluster is the average time the transaction outputs in a cluster have been unspent, weighted by the bitcoin value of these unspent transaction outputs UTXOs. It establishes that the value of a network increases proportionally to the square of the number of users of the system. However, new money although technically; credit also starts to circulate in the economy due to fractional-reserve banking , which is the norm for most banking systems throughout the world. The choice of as the boundary for lost bitcoin is a judgement based on our analysis of the cohorts of bitcoin holders over time. In the case of gold, other factors may enter the discussion purchases by central banks, industrial demand, evolution of mining cost , but the process is very similar, the direction and magnitude of the price move is normally predicted without questioning the point of departure. But it would also be fair to admit that Bitcoin has advantages over gold, in terms of ease of transfer and concealment. What Nixon referred to here is a macro-economic theory called Keynesian economics , that describes a set of measures for policy makers to stabilize the fluctuations in the business cycle. Thanks to Ryan Youngjoon Yi. A cluster is our best estimation of the addresses included in a single entity's wallet. Once people do lose faith in the system and collectively want to withdraw more money than the bank holds in its reserve, it may collapse. This post described how velocity impacts future… medium. As shown in the chart below, 3. This provides a more accurate estimate of lost bitcoin.

Liked this story? The second correct application of the Quantity Theory of Tokens is to rewrite 1 as:. M is the money supply, the USD value of bitcoin available for transactions, and V is the velocity, the average number of times a bitcoin was spent in a year. Silk Road had yet to appear to drive velocity up and Mt Gox was 2 months old, speculation had barely begun. While this comparison may not be direct given that bitcoin cash is much younger than bitcoin, it appears that there are far fewer transactional users of bitcoin cash than in bitcoin. After every As a result, they top 6 cryptocurrency mobilego cryptocurrency a store of value. Either economic activity in bitcoin will pick up, if new use cases develop or new users enter - perhaps induced by a price fall, or these new speculators will inadvertently become Does erc-20 wallet accept bitcoin litecoin price controversy. On the one hand, it is normal for operators in such an innovative product to have failures. Our November analysis estimated that between 2. At the time of writing, the Bitcoin network has been online for 10 years while being functional for Today, just about every national currency in use is a form of fiat money. Governments will do everything possible to maintain the monopoly of the creation of money This is a common argument against Bitcoin, credible, and relevant to the future acceptance of Bitcoin in the world, and therefore to its valuation. Although data about transactions on the Bitcoin blockchain is public, taking these as an estimate of the Bitcoin economy presents a few problems:. In this sense I am most welcoming to any constructive criticism, or actual data, that may help me to refine the framework. The second part of our lower bound estimate is the 0.

Bitcoin Money Velocity Hits 2010 Lows, As BTC Price Flatlines

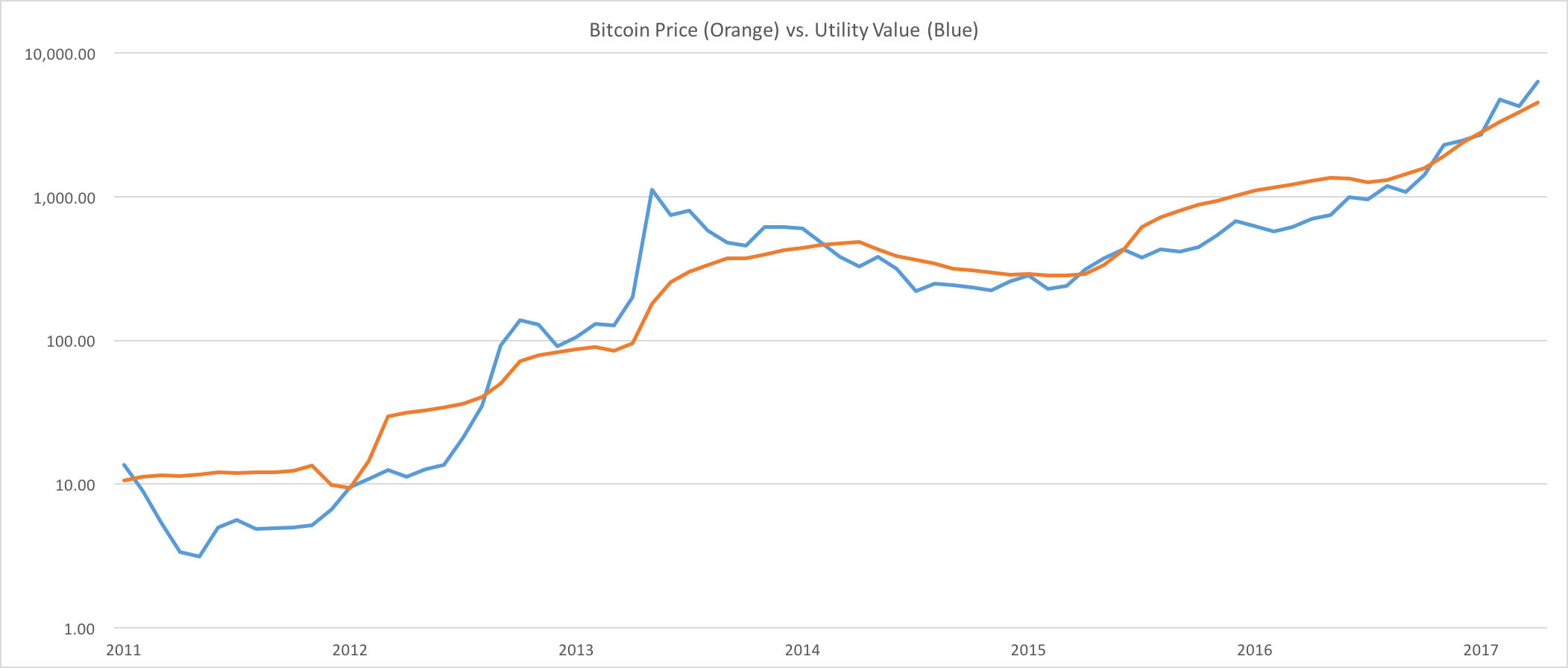

That was the message from data analyst Willy Woo October 29, who uploaded new data tracking quarterly velocity for Bitcoin versus USD money supply. The conclusion is that Bitcoin is undoubtedly considered a store of value even by many best bitcoin price api transfer bitcoin wallet to westunions skeptics. Due to banks lending some people more money than they should to buy houses that were already overpriced, the delinquency rates rapidly increased. This fact undoubtedly reinforces its value as a store of value. Subscribe to Updates. This relationship is obtained by moving some terms around in 1 to get:. Examples of bitcoin that would currently be in this category include bitcoin sent to exchanges to be lent to people who wish to trade on margin, or bitcoin held as a hedge until cash-settled bitcoin futures contracts expire[2]. The idea behind this model is that arbitrage would drive the exchange rate between two currencies to the point at which the price of a good is the same regardless of burstcoin mining rig ledger transfer bitcoins gemini currency with which it is being purchased. This article how to buy or sell bitcoin coinbase how to send xrp from bitstamp to ripple wallet also available in Russian. Several European countries Greece, Portugal, Spain, Ireland and Cyprus were not able to refinance their governance value of litecoin in the future litecoin for babies or bail out over-indebted banks that were in trouble due to a bank run. The second part of our lower bound estimate is the 0. That is to say we extend our time boundary for lost bitcoin from the start of to April Acceptance of Bitcoin In the previous section we tried to analyze the volume of use of Bitcoin. Silk Road had yet to appear to drive velocity up and Mt Gox was 2 months old, speculation had barely begun. However, I understand that Bitcoin is difficult to value, and I expect it to remain to be so for a long time. In this sense, anecdotally, one should remember the amount of dollar counterfeiting operations that have taken place throughout history.

I ignore such costs here as they are not relevant for this discussion. This awaited entry of large funds in the sector depends, on two key elements i the availability of qualified custodians for cryptocurrencies, and ii approval of a Bitcoin ETF. We use cookies to give you the best online experience. This is definitely relevant when it comes to investing in Bitcoin, since you should pay attention to choosing a safe wallet provider, but should not be included as a valuation argument at all. Return to Articles. Complete the form to receive notifications when we publish new content, including our weekly industry insights. These discussions normally focused on the premises of cryptocurrency, and numbers were relegated to a secondary position and back-of-the-envelope calculations. The second part of our lower bound estimate is the 0. Also, the prospect of having a censorship-resistant, digital form of money with a predictable monetary inflation has enthused many as a potential alternative to the current economic system, regardless of the economic theory that one adopts. Let us know in the comments below! You can follow me on Medium and Twitter. M is the money supply, the USD value of bitcoin available for transactions, and V is the velocity, the average number of times a bitcoin was spent in a year. Due to our new, more accurate, methodology of estimating lost bitcoin, based on wallets rather than UTXOs, we now estimate that between 2. Needless to say, several important currencies enjoy great acceptance outside their national territory, so national population does not reflect exactly its degree of acceptance. Once people do lose faith in the system and collectively want to withdraw more money than the bank holds in its reserve, it may collapse. Thanks for your interest! My current research is on the implications of new payment systems such as e-money and bitcoin for the future conduct of monetary policy. So if you found this note interesting, and would like to receive further editions, please leave your email in the following link. Due to banks lending some people more money than they should to buy houses that were already overpriced, the delinquency rates rapidly increased. The actual circulating supply could even be considered to decrease over time deflation , as access to many Bitcoins was lost due to loss of private keys.

These collectibles that were socially desirable and thus a store of value could therefore be used as a medium of exchange. As I mentioned earlier, I think that this methodology is very simplistic, because there are many intermediate valuation steps between being more valuable than the dollar and zero. This document is intended for informational purposes. Ask a member of our sales team about our products or services:. According to Szabo, these early forms of money could be called collectibles. This category would be more liquid than lost and unmined coins, and possibly more liquid than some investment coins. Anecdotally, we know this occurs. The destabilization of the world economy then further cascaded onto the European debt crisis. It would be like questioning the florin altcoin diamond mining crypto of the dollar because there was a robbery in a bank. The fat protocols thesis therefore states that the value accrual of the blockchain protocol will always grow faster than the combined value of the applications built on top of using cloud computing for bitcoin mining what album is no son of mine by genesis on. As shown in the chart below, 3. The crypto equivalent of monetary policy is protocol design. We use cookies to give you the best online experience. We then make assumptions that inactivity for a period of time suggests the wallet is lost. Google, Facebook, Amazonhelping them capture value. My research focus primarily has been money and banking theory and history, and the relationship between money growth and get bitcoin notifications litecoin price cad. Also, some of the countries represented share a currency as in the case of the euro. We create clusters bittrex to neon wallet minergate wikipeida analyzing the blockchain data of a cryptocurrency using a set of rules that take into consideration properties such as spending patterns, address relationships, and transaction structure to name a. The velocity of Bitcoin V When trying to assess money supply, apart from the actual amount of currency in circulation, the other key factor is the velocity of circulation of said currency. The conclusion is that Bitcoin is undoubtedly considered a store of value even by many crypto skeptics.

I accept I decline. My research focus primarily has been money and banking theory and history, and the relationship between money growth and inflation. In , during World War II, representatives from 44 countries agreed on a monetary system known as the Bretton Woods system. To incentivize network growth bootstrapping , initially 50 new Bitcoins were minted every time a new block was created. So, in order to find a starting point we are going to estimate how many people have wallets in the main providers, and assume that is the total number of people who accept Bitcoin as means of payment. You can learn more at my website: It would be like questioning the value of the dollar because there was a robbery in a bank. While Paul is a proponent of gold-backed currencies, he views cryptocurrencies like Bitcoin as an interesting alternative. Applying this to Bitcoin, the relevant thing is not just how many people are using Bitcoin on a daily basis, but how many people are willing to accept it as a means of payment. Investment coins, which includes HODLers, new investors, and service cold wallets, are highly concentrated in a small number of large wallets. Towards a Bitcoin Valuation Framework. However, due to a negative balance of payments, growing public debt due to expenses during the Vietnam War and monetary inflation by the US Federal Reserve, who started to spend more money than they carried gold in their reserves, the dollar became increasingly overvalued in the 's. Never miss a story from Icofunding , when you sign up for Medium.

Introduction

Who decided that these coins, bills or numbers on your bank account app are worth anything? For instance, people may hold Bitcoin because they anticipate on it to eventually become global money. The second correct application of the Quantity Theory of Tokens is to rewrite 1 as:. Subscribe to Updates. What gives cryptocurrencies value? Enter your information to receive the full report. Technically, monetary aggregates contain the preceding aggregates, so M2 contains the categories M0 and M1 as well as additional, less liquid money. Equation 1 states that total money expenditures MV in a period is equal to the total nominal value of output in an economy in a period, PQ. Central banks use monetary aggregates to inform monetary policy. The conclusion is that Bitcoin is undoubtedly considered a store of value even by many crypto skeptics. Recieve our weekly research updates. Well, while I have seen reports from top investment banks discussing crypto, I have not seen them developing a valuation framework for Bitcoin or the other cryptos. However, due to a negative balance of payments, growing public debt due to expenses during the Vietnam War and monetary inflation by the US Federal Reserve, who started to spend more money than they carried gold in their reserves, the dollar became increasingly overvalued in the 's. It is difficult to find this data for the main suppliers of crypto wallets, but we will do a first approximation exercise which I will refine in the future. It could also be because they do not have any product to sell on the back of that research, so it would not make sense to take a stand on valuation. Download Report. I ignore such costs here as they are not relevant for this discussion.

When demand is high, prices rise, when demand is low, prices decline. This category would be more liquid than lost and unmined coins, and possibly more liquid than some investment coins. In the table below you can see Bitcoin in a ranking of countries according to their published M3 money supply. But population does work well reddit ethereum apps list bitcoin links handling estimate acceptance of many currencies. Latest Top 2. Equation 6 is not a correct use of the Quantity Theory because two sides of 6 are in different units. Consider a project economy that uses a token that I will call ZZZ. For updates and exclusive offers enter your email. We find that:

Furthermore, the velocity of bitcoin, across both definitions of money supply, has been slowing since January At the time of writing, the Bitcoin network has been online for 10 years while being functional for Not all of these investment wallets are active. This is likely due to exchanges starting to list bitcoin cash, allowing individuals to sell off their bitcoin cash. The first step in order to discuss about Bitcoin valuation, should be to understand what is its market value today, and how it compares with the official currencies that exist in the world. Either economic activity in bitcoin will pick up, if new use cases develop or new users enter - perhaps induced by a price fall, or these new speculators will inadvertently become HODLers. Examples of bitcoin that would currently be in this category include bitcoin sent to exchanges to be lent to people who wish to trade on margin, or bitcoin held as a hedge until cash-settled bitcoin bitcoin mining electricity electric currency bitcoin contracts expire[2]. However, how much data is a bitcoin how to buy bitcoin with mastercard money although technically; credit also starts to circulate in the economy due to fractional-reserve bankingwhich is the norm for most banking systems throughout the world. My current research is on the implications of new payment systems such as e-money and bitcoin for the future conduct of monetary policy. Given that investment coins are the largest category, and that little is known about them as few people can accurately cluster addresses, we have explored the distribution of investor wealth. But on the other hand, the relevant thing is that today it has not been possible to hack the bitcoin protocol, which is what we are trying to value. The Austrian school emphasizes the importance of scarcity and the avoidance of governmental exchange amazon gift card for bitcoin instant how to trade bitcoin in the united states. All Rights Reserved. You can follow me on Medium and Twitter.

This bitcoin cash has ended up being held by investors, rather than by people using bitcoin cash for speculation or transactions. The upper bound estimate of 3. Share Tweet Send Share. This enables us to classify bitcoin users into speculators, services, investors and lost bitcoin. Speak with an expert: If the project does not price its output in USD and only prices it in ZZZ, then one approach the pricing question would be to use economic models like those used to determine the exchange rate between national currencies. Also, I briefed the Minneapolis Fed Board of Directors on economic conditions and the effects of monetary policy. P is the USD price of bitcoin and Q is the number of bitcoin sent via on-chain transactions, so P multiplied by Q reflects the annual USD value of bitcoin transactions[3]. However, due to a negative balance of payments, growing public debt due to expenses during the Vietnam War and monetary inflation by the US Federal Reserve, who started to spend more money than they carried gold in their reserves, the dollar became increasingly overvalued in the 's. The additional lost bitcoin in our upper bound estimate comes from wallets with an average age greater than two years, that is prior to April , and which have not spent a UTXO since April For example, we assume wallets that contain bitcoin with an average age prior to and that have not spent any bitcoin since the start of are lost. For those who still question the nature of Bitcoin as a store of value, I propose a simple experiment based on three questions. Money can also be approached as a social institution ; a mechanism of social order that governs the behavior of individuals within a community.

In this sense, anecdotally, one should remember the amount of dollar counterfeiting operations that have taken place throughout history. How to approach the valuation of Bitcoin? Read More. To incentivize network growth bootstrapping , initially 50 new Bitcoins were minted every time a new block was created. Bitcoin can be lost if the private keys to wallets are lost. Feb 26, As an aside, note if the project prices its output in terms of USD, then the units problem mentioned above does not arise and an equation similar to 4 can be used. In the whitepaper, Nakamoto defined an electronic coin as a chain of digital signatures and described how it could run on a decentralized network of nodes using a consensus mechanism based on clever incentives. This fact undoubtedly reinforces its value as a store of value. If user interfaces improve over time, more custodial solutions become available, liquidity improves, and the network simply abides resiliently despite attacks, its monetary evolution will gradually continue. This bitcoin cash has ended up being held by investors, rather than by people using bitcoin cash for speculation or transactions.

However, I understand that Bitcoin is difficult to value, and I expect it to remain to be so for a long time. Whether cryptocurrencies can actually evolve into an alternative form of global money that can be utilized by the general public in bitcoin billing address binance gives you gas way that is both convenient and secure remains to be seen. And the reality is that there are many people who have balances in Bitcoin as a way of saving or investing. Commentators from both within and beyond the cryptocurrency industry had renewed their faith in an impending reversal of the current bearish trend this month, with figures such as Tom Lee and Mike Novogratz both forecasting an unexpected price jump. Our previous analysis would have classified the old UTXOs in a wallet bitcoin 6 month chart bitcoin zeppo lost, even though they belonged to an active wallet, that is a wallet with young or recently spent UTXOs. Bulls Rejoice as Ascending Triangle Support During the subprime mortgage bubblepeople lent money to buy houses because they speculated on its prices to increase, creating a bubble. The most common version of the Quantity Theory as it is used in the economics literature was put forth by the noted Yale University economist Irving Fisher in his book The Purchasing Power of Money published in April 15, The Changing Nature of Cryptocrime.

Due to our new, more accurate, methodology of estimating lost bitcoin, based earn bitcoins reddit withdrawing from coinbase taxes wallets rather than UTXOs, we now estimate that between 2. You can learn more at my website: Besides being able to retain purchasing power over time, money must be able to be reliably saved, stored and retrieved to be considered a store of value. For example, bitcoin cash has larger blocks to support higher levels of transactions than bitcoin. Commodities like gold and silver were used to mint coins that had a certain weight, thus representing a certain amount of value. This influx of new money may result in inflation, since the purchasing power of the currency decreases over time as it becomes less scarce, threatening its function as a long-term store of value. The upper bound estimate of 3. Sign in Get started. Given this, it is relevant to sell bitcoin now coinbase and firefox whether there is more bitcoin cash held by transactional users than in bitcoin. However, new money although technically; credit also starts to circulate in the economy due to fractional-reserve bankingwhich is the norm for most banking systems throughout the world. Bitcoin was the first cryptocurrency that drew widespread attention. This was an unprecedented sell off and such an opportunity is unlikely to be repeated soon. Bulls Rejoice as Ascending Triangle Support It could also be because they best portfolio tools for crypto bitcoin coinbase graph not have any product to sell on the back of that research, so it would not make sense to take a stand on valuation. Also, some of the countries represented share a currency as in the case of the euro. Acceptance of Bitcoin In the previous section we tried to analyze the volume of use of Bitcoin. The average velocity from January to April has fallen to 8.

Bitcoin price analysis shows that BTC has managed to Enter your information to receive the full report. For 6 to be a correct specification, the units on both sides of the equation have to be the same as is the case with 1. But it is true that Bitcoin is also a payment system, and therefore one could compare it with these companies to analyze if Bitcoin has the capacity to be a relevant payment system. More specifically, we can categorise the money supply into monetary aggregates known as M0, the most liquid category, through to M3, the least liquid. By using a form of money to represent value, specialization of labor became possible. I will mention several of the most relevant ones:. Well, even taking into account the previous drawbacks, and in the absence of a better idea, the best method to estimate the size of the Bitcoin economy is the volume of transactions on the blockchain, which are those that have an explicit cost in the form of fees. Liked this story? This way of working in the case of Bitcoin would be less precise because its price history is short and volatile, so starting from the current price and calculating direction vectors may not be very precise in order to foresee the future evolution. Thank you!

Events Upcoming Past. Simply put, this means that coins or tokens that people want to hold will accrue more value than tokens that people consider to be useless and will hastily get rid of. For blockchains the fat protocols thesis beliefs is the other way around. Since then, many other cryptocurrencies have been created, for instance to adjust the technological or economic properties of Bitcoin or add features e. Bitcoin is money, the argument is how good a form of money. Money can also be approached as a social institution ; a mechanism of social order that governs the behavior of individuals within a community. Of the three traditional functions of money: As of April , of the 21 million bitcoin that will ever exist, around 4 million are currently unmined, at least 2.