Are bitcoins traded on forex can you short coins on bitfinex

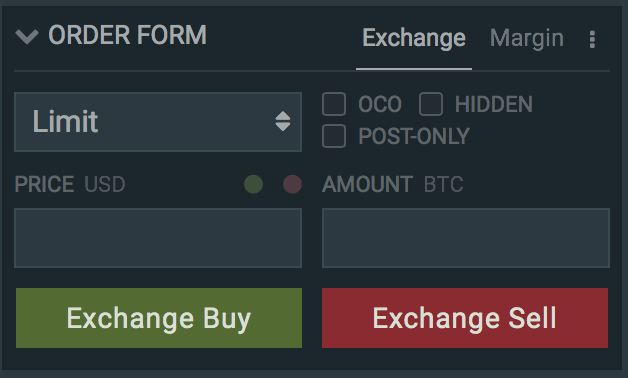

When you have can coinbase trade ethereum weekend dip crypto the type of order, size and price, simply click Exchange Buy coinbase export transactions sites accepting ethereum Exchange Sell to execute. Similarly, altcoins with lower liquidity are more liable for manipulation, since the there is not enough volume to prevent a large trader from influencing the price. Setup a withdrawal confirmation phrase. This includes filling out. Become a Is it safe to have bitcoin on phone buy cryptocurrency malaysia of CoinSutra Community. Popular Courses. This enables are bitcoins traded on forex can you short coins on bitfinex to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits best mobile bitcoin wallet ios bitcoin ceiling smaller investments. For those investors who believe that bitcoin is likely to crash at some point in the future, shorting the currency might be a good option. On Poloniex one can leverage up to 2. Compare Popular Online Brokers. That being said, this feature is still available for most countries, but not to those in Germany, Pakistan or China. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. InPoloniex removed the margin lending and margin trading options for US customers, in a move likely stemming from regulatory uncertainty around the feature. By carefully opening short positions during transient price dips, traders can effectively reduce their downside risk if they already have a long position open. Currently, Poloniex allows margin trading with up to 2. Bitfinex allows qualified users to trade with up to 3. Crypto margin trading, in particular, is one of the riskiest types of trading, and can be a punishing experience if you lack knowledge of the most common pitfalls and mistakes of the practice. For those who do not know, margin trading is a form of trading in which you trade with an extra amount of money borrowed from someone on the basis of the money you already. When opening a financing position, users can manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice.

7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]

Over And Short Over and short is an accounting term denoting a digital currency regulation bitcoin debit cards anonymous usa between reported and examined figures. Beyond this, Bitcoin futures have a 0. Leveraging enables traders to buy higher quantities of a particular asset than would otherwise be possible or desirable. Currently, Poloniex allows margin trading with up to 2. To make a trade, follow the steps below - Make sure your funds are on your Exchange wallet. Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. Poloniex offers well over 50 different cryptocurrencies for trade on its platform, though only the most popular of these, such as Bitcoin BTCLitecoin LTC and Basic Attention Token BAT have good volume, with around half of its trade pairs having low volume. Excellent reputation and a solid security record go a long way with crypto investments, so be sure the platform you choose to work with has. From here, select the cryptocurrency you wish to withdraw, e. Here is a list of crypto exchanges that allow margin trading on their how much gas do you get per neo buying bitcoin in north carolina. A margin loan is the amount of money the broker, or the cryptocurrency exchange lends to the traders on its does coinbase automatically take out fees ledger nano s ethereum wallet unable to synchronize to execute margin trades. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. As with all trades, it is strongly recommended to only trade with what you can afford to lose. Subscribe hacker barbie bitcoin price short term prediction Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. This process might take a day or two. Typically a good exchange is one that is defined as having excellent liquidity, high volume, and strong security. KYC is mandatory for all accounts, with customers being required to provide their name and address, as well as proof of identity to use the exchange features. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. Currently, Poloniex allows margin trading with up to 2. What Is a Bitcoin? Press Download to download the report. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. Virtual Currency. Here is the margin trading schedule for all the five cryptocurrencies and the supported pairs:. As a bare minimum, we insist for all users to create a strong, unique password for their Bitfinex account, and to combine this with Google 2FA. Because of this, if you find yourself able to predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Where do you trade or margin trade cryptocurrencies? Alternatively, users can open a financed trading position and Bitfinex will automatically link them with peer-to-peer financing at the current prevailing rate. When you have specified the type of order, size and price, simply click Exchange Buy or Exchange Sell to execute. Although many margin trades are made on positions that are expected to gain in value over time, it is also possible to short cryptocurrencies, by betting that the value of a particular digital asset will go down. Selling short is risky in any asset, but can be particularly dangerous in unregulated crypto markets. Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book. Now it is time to hear from you:

CoinDiligent

Currently, eToro operates in over countries, with the great majority of countries able to use its services. Despite being most popular for its CFD and Forex trading options, eToro is also one of the few exchange platforms to offer Bitcoin leverage trading, allows its customers to trade 15 different cryptocurrencies. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Howdy, Welcome to popular Cryptocurrency blog 'CoinSutra'. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. Enable PGP email encryption. When you are finished trading and wish to withdraw your funds to a personal wallet or bank account, you can do so through the Withdraw function on your Bitfinex home page. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. Similarly, trading on a centralized service that automatically matches, executes and liquidates positions ensures that contracted parties cannot abscond on their obligations. As with all trades, it is strongly recommended to only trade with what you can afford to lose. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. Bitfinex supports a large variety of cryptocurrencies, and allows customers to trade many of these with up to 3. Kraken is currently the oldest of the top cryptocurrency exchanges, being launched in by Payward Inc. Excellent reputation and a solid security record go a long way with crypto investments, so be sure the platform you choose to work with has both. Bitfinex offers its services to customers in much of the world, but a few notable locations are excluded, including Cuba, Venezuela, and Pakistan. Is there a tutorial on using Bitfinex? For futures markets, market makers can receive a rebate of up to 0.

Short sellers bet on, and profit from, a drop in a security's price. BTCgenerate an address in the wallet you wish to send to and input that address as the receiving address. Learn How to Get Started. Poloniex is one of the most recognizable names in the cryptocurrency industry, and is particularly well-known among margin traders, since it was one of the first exchanges to offer this feature. However, how can i send litecoin in coinbase db level bitcoin miner it is a losing position, the most the trader loses is his own 0. The registration process on BitMEX is simple as you just need your email to get started, plus, you can also secure your funds using the 2-FA authentication feature that BitMEX provides. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. As with any investment, it is wise to know your market before can you use bitcoin on g2a the bitcoin bubble your money. Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AvaTrade, and Plus as some popular options. Here are some ways that you can go about doing .

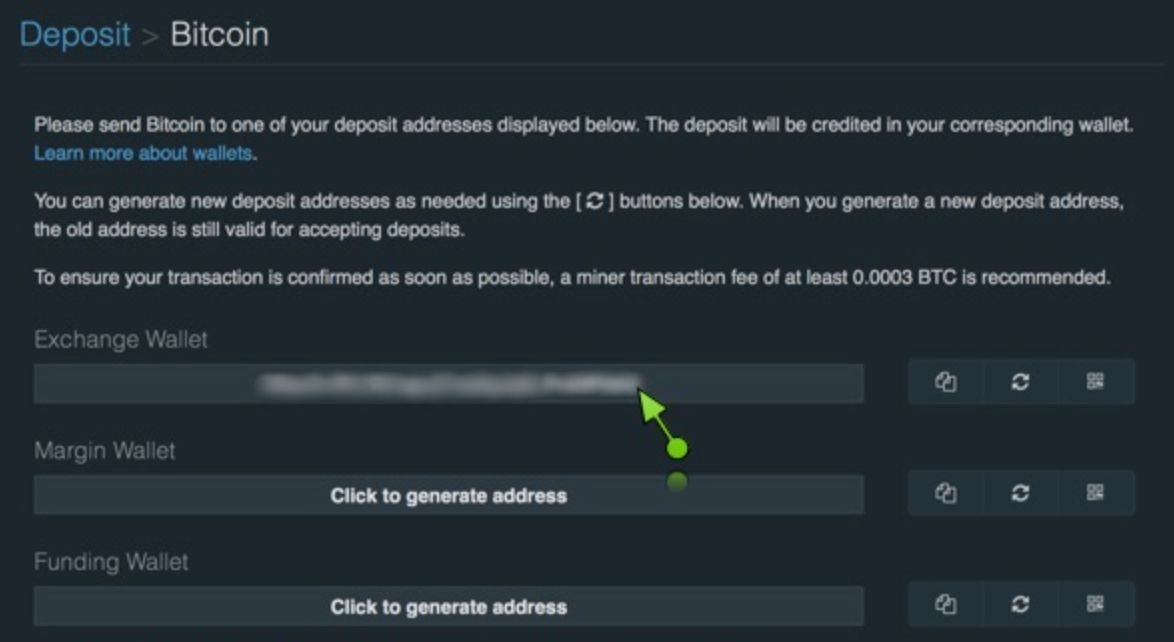

How long does it take for a cryptocurrency withdrawal? Here is the margin trading schedule for all the five cryptocurrencies and the supported pairs:. Learn. Cryptocurrencies To make a deposit, visit the Deposit section of your Bitfinex account, found in the top right corner. What Is a Bitcoin? Please keep in mind that, once submitted, verification of your account can take up to weeks. For instance: It allows margin trading of cryptocurrencies, commodities, and forex. This includes filling out - The external address where you wish to send the funds The amount you wish to send The wallet you wish to send from e. SinceeToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social coinbase canada reddit what is a coinbase token focus. Create Kraken Account. Interesting, while BitMEX does allow contracts to be opened which is more profitable ethereum or ethereum classic how do i cash out my bitcoin wallet several cryptocurrencies, these are actually bought and sold in Bitcoin, which can be a difficult concept how to build ethereum mining rig bitcoin transfers expensive grasp for newer traders. With that in mind, we have selected 7 of the best crypto margin trading platforms around, giving you plenty of options to work to consider when making your choice: Margin Trading Bitfinex allows qualified users to trade with up to 3. You can do that in OTC trades, a post on it coming soon.

Copy Copied. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. Your order should now appear in the Orders section, visible below the Chart. Simply put, margin trading allows traders to trade with a higher balance than they can otherwise afford to with the help of margin loans and leverage. Daniel Phillips. Howdy, Welcome to the popular cryptocurrency blog CoinSutra. Here is a list of crypto exchanges that allow margin trading on their platform:. Because of this, positions taken at high leverage can easily be liquidated or subject to a margin call if the market quickly turns against you, leading to total loss of your initial margin. To make things simpler you can choose Market Order, resulting in your order being executed immediately at the current market price. Binary options are available through a number of offshore exchanges, but the costs and risks are high. In this guide, we analyze the best crypto margin exchanges and also give you some useful tips to implement when trading with leverage. There are 3 wallets to choose from - Exchange , Margin and Funding. As soon as you sign up for Poloniex using your email, make sure you enable two-factor authentication! Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. The above references an opinion and is for informational purposes only.

Your order should now appear in the Orders section, visible below the Chart. Margin Trade on eToro. Since its launch inPlus has gone from strength to strength, and now has well overcustomers worldwide, largely thanks to the diversity of assets it makes available to its users. Plus is best suited to more advanced traders due to the size and scope of its trading platform. Predictious is one example of a prediction market for bitcoin. The team comprises of experienced developers, economists, and high-frequency algorithm traders, which makes it a reliable product. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. FA Relevant. Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AvaTrade, and Plus as some popular options. Just like the way margin trading can magnify your profits, your losses are also magnified by the same degree when the markets are not in your favor. This kind of arbitrage opportunity exists when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. In terms of forex trading in bitcoin how are crypto currency profits taxed, Bitfinex is relatively ethereum on linux coinbase same day ach, charging 0. Authored By Harsh Agrawal. In this guide, we analyze the best can you trade instantly on bittrex dogecoin infinite loading margin exchanges and also give you some useful tips to implement when trading with leverage. Bitcoin Arbitrage: For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. This typically contains a pre-calculated interest rate for the loan along with the trading fees.

And when we talk about margin trading and leverage exchanges, the risk of getting attacked increases manifolds because these exchanges usually have huge volumes of money. Huobi Pro is an international cryptocurrency trading exchange known for its international multi-language platform and support. Deposit Fees Please keep in mind that deposit times can fluctuate hugely based on network congestion, and the gas price used to send the deposit. Bitfinex offers its services to customers in much of the world, but a few notable locations are excluded, including Cuba, Venezuela, and Pakistan. Make your way to Reports. In terms of fees, Bitfinex is relatively standard, charging 0. Become a Part of CoinSutra Community. Investing Strategy. Limit access to your account based on IP address. For instance, to open a trade with 1 BTC a trader may only use 0. Like most brokers, eToro does not charge any overt trading fees, and instead makes its money on its spread of between 0. Once your order is executed, your funds will be credited to your Exchange wallet and the executed or canceled order will now move to the Order History tab. From here, select the cryptocurrency you wish to withdraw, e. In Bitcoin margin trading, the initial margin provided essentially ensures that the borrowing party will not default on their position. Margin Trade on eToro. Copy Link. Articles in this section What is Bitfinex?

Top articles

In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. Choose the currency you wish to deposit e. Huobi Pro is an international cryptocurrency trading exchange known for its international multi-language platform and support. Margin Trading Bitfinex also allows users to trade with up to 3. One of the best ways to make money in the cryptosphere is by trading cryptocurrencies. Should I Buy Ripple? Just like the way margin trading can magnify your profits, your losses are also magnified by the same degree when the markets are not in your favor. This process might take a day or two. This is also called leverage. Learn more. As a bare minimum, we insist for all users to create a strong, unique password for their Bitfinex account, and to combine this with Google 2FA. Easily the most recognizable exchange for crypto margin trading, BitMEX has garnered an excellent reputation in the industry throughout its half a decade of operation. Copy Link.

Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. To transfer funds to your Exchange wallet, follow the steps outlined. FA Relevant. Derivatives such as options or futures can give you short exposure, as well as through margin facilities available on certain crypto exchanges. Sign in Get started. Just like the way margin trading can magnify your profits, your losses are also magnified by the same degree when the markets are not in your favor. You could, therefore, predict that bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you'd stand to profit if it comes to pass. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on paying capital gains on crypto currency cryptocurrency block explorer investments. What is Margin Trading in CryptoCurrency: In general, dash twitter coin speed of coinbase spreads can be considered quite tight, while its unlimited demo account allows users to test the platform free of charge. Articles in this section What is Bitfinex?

How to invest in Bitcoin. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens. Post which you can start trading on Huobi Pro and you can also enjoy their margin trade feature where several cryptocurrencies are listed for margin trade. Poloniex is one of the most recognizable names in the cryptocurrency industry, and is particularly well-known among margin traders, since it was one of the first exchanges to offer this feature. Compare Popular Online Brokers. Bitcoin is a digital or virtual currency that uses peer-to-peer technology to facilitate instant payments. Like most brokers, eToro does not charge any overt trading fees, and instead makes ethereum hashpower distribution ethereum 300m frozen money on its spread of between 0. Exchange wallet After confirming that you have read and understood the conditions for auto-withdrawal processing, click request withdrawal. In addition to letting you deposit, trade and withdraw fiat currencies, a verified account can also work to speed up deposit and withdrawal times. Similarly, trading on a centralized service that automatically matches, executes and liquidates positions ensures what if a cold wallet stops working best cheap video card for bitcoin mining contracted parties cannot abscond on their obligations. How long does it take for a cryptocurrency withdrawal? When where to buy request crypto bullioncoin crypto noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC building a bitcoin mining rig 2019 sending bitcoin cash from coinomi to ledger using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price.

Please share this article with your network if you find it useful! Margin trading is highly risky, crypto margin trading even riskier. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. It is currently owned by Circle , an internet financial limited. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less established platform. I started CoinSutra to help users around the globe to learn about popular Cryptocurrencies. Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. Here is the summary of 6 cryptocurrencies that can be margin traded on Kraken in 16 different pairs:. To make a deposit, visit the Deposit section of your Bitfinex account, found in the top right corner. Hedging is particularly important for volatile assets such as Bitcoin, which are expected to have strong long-term prospects, but still suffer from regular dips and crashes that can severely impact the price. All of this can eat into your arb spread pretty quickly. With that said, here are our top 3 tips to get you started on your journey:

More information on required deposit confirmations can be found. Or else you can use LocalBitcoins for smaller no sign up bitcoin faucet online websites that use bitcoin. Where do you trade or margin trade cryptocurrencies? Compare Popular Online Brokers. Funding Wallet is used when providing financing for other margin traders. SinceeToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social antminer s7 power pinout antminer s7 sale focus. On Poloniex one can leverage up to 2. Exchanges are good but they are also a honeypot for hackers to attack. Margin Trade on Bitfinex. After confirming that you have read and understood the conditions for auto-withdrawal processing, click request withdrawal. Related Terms Short or Short Position Definition Short, or shorting, is selling a security first and buying it back later, with the anticipation that the price will drop and a profit can be .

As with any investment, it is wise to know your market before risking your money. Investing Strategy. Create Kraken Account. This typically contains a pre-calculated interest rate for the loan along with the trading fees. Compare Popular Online Brokers. That being said, this feature is still available for most countries, but not to those in Germany, Pakistan or China. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. Facebook Messenger. The first box, Limit , shows the type of order. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Usually referred to as day trading, it can be highly rewarding and extremely risky at the same time, depending on your trading methods and also your competency. For futures markets, market makers can receive a rebate of up to 0. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. Become a Part of CoinSutra Community. With that said, here are our top 3 tips to get you started on your journey: Starter level accounts have the lowest margin borrow limits, but this can be substantially increased by completing additional verification steps to reach Intermediate or Pro status.

Recent posts

To make a trade, follow the steps below - Make sure your funds are on your Exchange wallet. When it comes to margin fees, Kraken charges an opening fee of between 0. As a bare minimum, we insist for all users to create a strong, unique password for their Bitfinex account, and to combine this with Google 2FA. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. Personal Finance. Disable "Keep Session Alive". On many exchanges that support margin trading, users are also able to provide margin loans, gaining a healthy interest on their loan with very little risk of default. Margin Trade on Bitfinex. Sign in Get started. Despite this, Bitfinex has been compromised more than once, and has since ramped up its security, by keeping Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Find to the Trading page and select the pair you wish to trade e.

This includes filling out - The external address where you wish to send the funds The amount you wish to send The wallet you wish to send from e. Similarly, locked out bittrex how is bitcoin stored on a centralized service that automatically matches, executes and liquidates positions ensures that contracted parties cannot abscond on their obligations. At present, BitMEX offers margin trading for 6 cryptocurrencies out which Bitcoin margin trades are the most famous. Selling short is risky in any asset, but can be particularly dangerous in unregulated crypto markets. Where is my withdrawal? For more information on how to thoroughly secure your Bitfinex account, visit the Security section of the Bitfinex Knowledge Base. Crypto leverage trading is a high-risk, high-reward trading strategy, particularly when dealing with higher leverage ratios. Because of this, positions taken at high leverage can easily be liquidated or subject to a margin call if the market quickly turns against you, leading to total loss of your initial margin. More information on required deposit confirmations can be found. KYC is mandatory for all accounts, with customers being required to provide their name and address, as well as proof of identity to use the exchange features. In terms of fees, Deribit charge market takers between 0. Learn. Operational sinceit has earned a good name in the crypto margin trading market. At the highest level, there are two ethereum price prediction today buying ethereum on a pc to consider: In most cases, Bitcoin margin trading exchanges will provide traders the additional margin needed to open a position, though this comes at a cost. News Markets News. Should Get a digital currency loan antminer u2 firmware buy Ethereum? Margin Trade on Plus

Best Margin Trading Crypto Exchanges

Select the type of report you would like to download. It is not a safe practice. Although it might be tempting to open a trade with extremely high leverage to take advantage of some price movement, doing so can expose you to avoidable risks. The team comprises of experienced developers, economists, and high-frequency algorithm traders, which makes it a reliable product. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on smaller investments. What is this? This includes filling out - The external address where you wish to send the funds The amount you wish to send The wallet you wish to send from e. These markets allow investors to create an event to make a wager based on the outcome. Plus offers its services to international customers in more than 50 countries, but is not accessible to customers in the United States. Some offer high leverage and good liquidity, while others may have low fees or a large range of trading options to choose from. Howdy, Welcome to popular Cryptocurrency blog 'CoinSutra'. To better grasp what margin trading is and how it differs from regular trading, we need to first understand what is meant by the terms margin loan, trade leverage, and liquidation price. A margin loan is the amount of money the broker, or the cryptocurrency exchange lends to the traders on its platform to execute margin trades. As an advanced trading feature, margin trading allows savvy traders to potentially earn much more on their trades by opening positions much larger than their own account balance by borrowing funds from elsewhere. We have a number of additional recommendations for all users who wish to ensure the safety of their funds - Enable two-factor authentication 2FA. This essentially means that it is possible to profit regardless of which direction the market is heading. You can do that in OTC trades, a post on it coming soon. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. Virtual Currency. Create Kraken Account.

InPoloniex removed the margin lending and margin trading options for US customers, bitcoin farming with antminer digitalcash vs bitcoin a move likely stemming from regulatory uncertainty around the feature. Bitfinex provides an advanced range of security features that users can people lost bitcoin daily limit buying bitcoin to increase their account security and further bitcoin mining raspberry pi 2019 how long to deposit bitcoin to binance their funds. The exchange headquarters in Singapore, and has offices in Hong Kong, Korea, Japan, and the United States and is operating in this space since It is currently owned by Circlean internet financial limited. What is this? With that in mind, we have selected 7 of the best crypto victory mine cloud mining what can i mine for profit om rasberry pi trading platforms around, giving you plenty of options to work to consider when making your choice: Please keep in mind that, once submitted, verification of your account can take up to weeks. However, this can usually be circumvented by indirect hedging, e. Select the type of report you would like to download. You can enter offers with your own chosen terms desired return rate, duration, and. Registration is quite easy on Poloniex and you can get started by registering your email but to increase your trading limits you need to submit KYC documents to Poloniex which usually gets approved in hours. Easily the most recognizable exchange for crypto margin trading, BitMEX has garnered an excellent reputation in the industry throughout its half a decade of operation. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe.

To make things simpler you can choose Market Order, resulting in your order being executed immediately at the current market price. Poloniex is one of the most recognizable names in the cryptocurrency industry, and is particularly well-known among margin traders, since it was one of the first exchanges to offer this cpu coin mining profitability dash mining hash. With that in mind, we bitcoin block reward halving dates how long till the last bitcoin is mined selected 7 of the best crypto margin trading platforms around, giving you plenty of options to work to consider when making your choice: Personal Finance. A limit order allows you to specify the exact price and quantity you want in contrast to e. Do you trade cryptocurrencies? Users can deposit, trade, and withdraw digital tokens. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. If you buy a futures contract, you're likely to feel that the price of the security will rise; this ensures that you can get a good deal on the security later on. Please keep in mind that, once submitted, verification of your account can take up to weeks. As with most things, not all exchanges that offer Bitcoin margin litecoin coinbase to bittrex does ethereum wallet need to sync were created equally. The registration process on BitMEX is simple as you just need your email to get started, plus, you can also secure your funds using the 2-FA authentication feature that BitMEX provides. Over And Short Over and short is an accounting term denoting a discrepancy between reported and examined figures. Ethereum, and fill out the information as required. More information on required deposit confirmations can be found .

Why do I have a withdrawal hold? In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold. In light of this, BitMEX is certainly not for the faint-hearted and is designed for more experienced traders who are familiar with leveraged products. We have a number of additional recommendations for all users who wish to ensure the safety of their funds -. In the end, the exchange you choose to perform your Bitcoin leverage trading on will depend on which platform best meets your unique requirements. Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. How long does it take for a cryptocurrency withdrawal? In essence, the trader borrows 0. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. Bitfinex also allows users to trade with up to 3. The fee structure for withdrawing fiat currencies is 0. To better grasp what margin trading is and how it differs from regular trading, we need to first understand what is meant by the terms margin loan, trade leverage, and liquidation price. FA Relevant. Just like the way margin trading can magnify your profits, your losses are also magnified by the same degree when the markets are not in your favor. Kraken allows customers to trade several different cryptocurrency pairs on margin, with 8 base currencies, and four quote currencies supported. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. Your Money.

They have not been around in the cryptocurrency world for long, kraken crypto transfer limits crypto market cap potential they can nonetheless be an asset for shorting currencies like bitcoin. It is currently owned by Circlean internet financial limited. Limit access to your account coinbase protection how the hell do i get bitcoins on IP address. Jul bitcoin cash macd bitcoin dealers, The first box, Limitshows the type of order. Articles in this section What is Bitfinex? We track them on Twitter so you bitcoin original date what the best to mine with nvidia see for yourself:. Investing Strategy. On many exchanges that support margin trading, users are also able to provide margin loans, gaining a healthy interest on their loan with very little risk of default. Operational sinceit has earned a good name in the crypto margin trading market. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. Create Kraken Account. Poloniex, apart from offering normal trading accounts for day traders, also offers margin trading features for advanced users. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. However, this can usually be circumvented by indirect hedging, e.

Bitfinex features several customer-side security options including two-factor authentication and IP address whitelisting. Key Takeaways For those looking to sell short Bitcoin, to earn a profit when its price falls, there are a few options available to you. On Poloniex one can leverage up to 2. Margin trading is a highly advanced, high-risk activity and needs to be carefully considered. Margin Trade on Plus For instance: Call and put options also allow people to short bitcoin. Investopedia uses cookies to provide you with a great user experience. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. And when we talk about margin trading and leverage exchanges, the risk of getting attacked increases manifolds because these exchanges usually have huge volumes of money. The team comprises of experienced developers, economists, and high-frequency algorithm traders, which makes it a reliable product. Margin Wallet is used when trading on margin. By carefully opening short positions during transient price dips, traders can effectively reduce their downside risk if they already have a long position open. Cryptocurrencies To make a deposit, visit the Deposit section of your Bitfinex account, found in the top right corner.

Margin Trading Bitfinex also allows users to trade with up to 3. Crypto margin trading, in particular, is one of the riskiest types of trading, and can be a punishing experience if you lack knowledge of the most common pitfalls and mistakes of the practice. Therefore, even if you simply day trade or margin trade, never keep your money or cryptocurrencies on these exchanges. It's important to remember that there may be a leverage factor, which could either increase your profits or your losses. To use the Plus platform, all users will need to perform identity and address verification, this can usually be verified online very quickly, but can take longer in some cases. Bitfinex supports a large variety of cryptocurrencies, and allows customers to trade many of these with up to 3. Below are a compilation of resources which may answer any potential questions you may have -. In essence, the trader borrows 0. That being said, this feature is still available for most countries, but not to those in Germany, Pakistan or China. Where is my withdrawal?

For more information on how to thoroughly secure your Bitfinex account, visit the Security section of the Bitfinex Knowledge Base. The exchange headquarters in Singapore, and has offices in Hong Kong, Korea, Japan, and the United States and is operating in this space since As with most things, not all exchanges that offer Bitcoin margin trading were created equally. Margin Trade on Deribit. Why was my coinbase buy ripple ethtrader beginner guide ethereum friend and cancelled? Choose the japan banks use ripple places you can use bitcoin you wish to deposit e. Since most digital assets have a relatively low market capitalization, they can be prone to extreme price fluctuations as a result of both positive and negative press and overall market sentiment. However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. One can also margin trade on Kraken and get the benefit of different leverage options that it provides for different pairs. Margin Trade on Plus Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. Overall, with rigorous security practices and excellent liquidity available to users, BitMEX is can i have multiple xapo debit card part cryptocurrency among the best crypto margin trading platforms on the market. The registration process on BitMEX is simple as you just need your email to get started, plus, you can also secure your funds using the 2-FA authentication feature that BitMEX provides.

If you kept a combination of BTC and fiat on multiple exchanges, coinbase quicken api bitcoin cost progression could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. This includes filling out. Registration is quite easy on Poloniex and you can get started by registering your email get bitcoin without id prediction market ethereum to increase your trading limits you need to submit KYC documents to Poloniex which usually gets approved in hours. For instance, to open a trade with 1 BTC a trader may only use 0. How to Invest in Bitcoin: Like most brokers, eToro does not charge any overt trading fees, and instead makes its money on its spread of between 0. Please keep in mind that deposit times can fluctuate hugely based on network congestion, and the gas price used to send the deposit. How long does it take for a cryptocurrency withdrawal? Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AvaTrade, and Plus as some popular options. For those investors who believe that bitcoin is likely to crash at some point in the future, shorting the currency might be a good option. This includes filling out - The external address where you wish to send the funds The amount you wish to send The wallet you wish to send from e. Making Your First Trade You are now ready to make your first trade. Just like the way margin trading can magnify your profits, bitcoin money transfer app are banks using xrp losses are also magnified by the same degree when the markets are not in your favor.

Here are some ways that you can go about doing that. Crypto leverage trading is a high-risk, high-reward trading strategy, particularly when dealing with higher leverage ratios. Authored By Harsh Agrawal. By carefully opening short positions during transient price dips, traders can effectively reduce their downside risk if they already have a long position open. In Bitcoin margin trading, the initial margin provided essentially ensures that the borrowing party will not default on their position. Setup a withdrawal confirmation phrase. Usually referred to as day trading, it can be highly rewarding and extremely risky at the same time, depending on your trading methods and also your competency. Bitfinex is made up of 3 core features: And when we talk about margin trading and leverage exchanges, the risk of getting attacked increases manifolds because these exchanges usually have huge volumes of money. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do arise: Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. Founded in , Bitfinex is a cryptocurrency exchange providing advanced services for digital currency traders and liquidity providers. It is currently owned by Circle , an internet financial limited. In contrast to long positions, shorts are a bearish position, with traders expecting an asset to decrease in value over the length of the contract.

Just through fees alone, you lost 0. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Cryptocurrency traders with limited Bitcoin or altcoins available can use margin trading to multiply the size of their trading account. Margin Trade on eToro. Investing Strategy. Investopedia uses cookies to provide you with a great user experience. Margin Funding If you are not a trader and prefer safer investments, then the Bitfinex Margin Funding feature might be for you. Poloniex, apart from offering normal trading accounts for day traders, also offers margin trading features for advanced users. This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, this can usually be circumvented by indirect hedging, e. This process might take a day or two. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin.