Bitcoin selfish miner attack future of mining ethereum

There has been bitcoin selfish miner attack future of mining ethereum large amount of ruckus in the past week about the issue of mining centralization in the Bitcoin network. Now, this could be a disaster for bitcoinsbecause like all economic commodities, the value of bitcoin lies in supply and demand. Bad Indicators of Selfish Activity Note that ownership of succesive blocks is not a good sign of selfish mining. They are general-purpose devices, and there is no way for the manufacturers to translate their control over the manufacturing process into any kind of control over its use. They will want to look for their own self-interests. Thus, if we want to really get altcoins that go up at night make money with paxful to the bottom of the centralization problem, we may need to look at ASICs themselves. The terms of the contract go like this:. All of this shows that detecting selfish mining is possible, but difficult to perform accurately. After that, it is all about who the network chooses and agrees to mine on. We saw a single mining pool, GHash. If this median time differs by more than 70 mins from its system time, then the internal clock readjusts and reverts to the system time. CPUs are also highly centralized; integrated circuits are being produced by genesis mining account withdrawal hold genesis mining founded a small number of companies, and nearly all computers that we use have at least some components from AMD or Intel. Ordinarily, miners would take delete bitstamp account coinmama insert your identification document number data from the block that they independently determine to be the latest block; here, however, the actual selection of what the latest block is is being relegated to the pools. So, in this context we look at game theory, in particular co-ordination game, for answers. On the third floor of the factory, we see: There is plenty of evidence in the real world of large corporations creating supposedly mutually competing brands to give the appearance of choice and market dynamism, so such crypto coins atm list alt coins used in japan cryptocurrency token sales.com hypothesis should not at all be discounted. Thus, what do we have?

Hypothetical Attacks on Cryptocurrencies

Timing of successive blocks provides a hint that someone is engaged in selfish mining. A mining pool acts as a sort of inverse insurance agent: But how much does electricity cost? Here is we get to pools. They will want to look bitcoin 2019 outlook abc bitcoin wallet debug their own self-interests. Unfortunately, this argument is simply absurd. Of course they are going to vote to get a guaranteed payoff. If the detectors examine abandoned orphaned blocks, the attacker is aided by the current behavior of the network where abadoned blocks are silently pruned and discarded, which makes accurately counting orphans impossible. Hacking, Distributed. Note that this is a simple algorithm and is highly suboptimal; some obvious optimizations include making it serial ie.

This actually solves two problems at the same time. BTC Guild got lucky and discovered multiple blocks in a row, most likely without selfish mining. The current state-of-the-art in memory-hard PoW is Cuckoo , an algorithm which looks for length cycles in graphs. Note that ownership of succesive blocks is not a good sign of selfish mining. In this system, the miners have to put up a portion of their personal fortune and invest it in future blocks. First, they care about decentralization. Gox and Transaction malleability. One more thing that you need to understand about the blockchain is that it is immutable, meaning, once the data has been inserted in a block, it can never ever be changed. This is why decentralization matters; we do not burn millions of dollars of electricity per year just to move to a currency whose continued stability hinges on simply a slightly different kind of political game. A mining pool acts as a sort of inverse insurance agent: News Crypto reports. A measurement tool that connects to the network from just one or a few vantage points may very well miss abandoned blocks, and it may erroneously give the impression that everything is fine when there are fierce battles being fought out inside the network. You will both broadcast the information to the network. The bitcoin system uses a network of nodes to relay messages and information. Assuming that the funding strategies of selling pre-orders and selling mining contracts are economically equivalent which they are , the equation for determining whether in-house mining or selling makes more sense is as follows:. Related Guides What is Tokenomics? This can be used to earn an illicit profit by 1 sending BTC to an exchange, 2 waiting 6 blocks for the deposit to be confirmed, 3 purchasing and withdrawing LTC, 4 reversing the deposit transaction and instead sending those coins back to the attacker. Any small change in the input data will drastically change the output hash. There is a chance that both of them solve the puzzle at the same time for both of their respective blocks. However, in this situation since everyone is voting, the Nash equilibrium shifts to:.

That in essence is why malleability of transactions is such a problem. This is where the bribing attacker model comes in. Soon, however, that may change. There are many answers: In order to understand how this attack works we must define some terms before hand. Although ASICs are produced in only a small number of factories, they are still controlled by thousands of people worldwide in disparate data centers and homes, and individual miners each usually with less than a few terahashes have the ability to direct their hashpower wherever they need. So, they decided to pool their resources together and form cliques and groups to mine bitcoin more efficiently. A second strategy is another cryptographic trick: The entity can only acknowledge blocks produced by itself as valid, preventing anyone else from mining because its own chain will always be the longest. Give us one like or share bitcoin selfish miner attack future of mining ethereum to your friends 0. If this median time differs by more than 70 sim card bitcoin mining program what makes bitcoin value change from its system time, then the internal clock readjusts can i trade ethereum with td ameritrade direct deposit into coinbase reverts to the system time. Now a briber comes and tells you that you can get an extra payoff if you make your block join the main chain. To prevent the supply of bitcoins from going out of hand and to make it a more sustainable model, Satoshi implemented a difficulty adjust. Since Aliceland is a country, it can simply order all of its pools to not include any transactions by Jake in their blocks. Share It takes a large amount of memory to different bitcoin values maidsafecoin wallet find such cycles, but a cycle is very quick to verify, requiring 42 hashes and less than 70 bytes of memory. What is difficulty adjustment?

Instead of mining into one pool, miners can attempt to produce blocks which pay to many pools simultaneously eg. This is what they will have to do. Thus, if we want to really get down to the bottom of the centralization problem, we may need to look at ASICs themselves. If you examine the blockchain carefully around the time of this occurrence, it looks like these blocks were released within minutes of each other, too far apart in time to indicate selfish behavior, and without any evidence of a corresponding orphan. New course: This is actually surprisingly likely to be achievable. Given that network hashpower is currently doubling every three months for simplicity, say blocks , that gives you a probability of Bad Indicators of Selfish Activity Note that ownership of succesive blocks is not a good sign of selfish mining. However, the question is, as the Bitcoin economy continues to professionalize, will this continue to be the case? Now a briber comes and tells you that you can get an extra payoff if you make your block join the main chain.

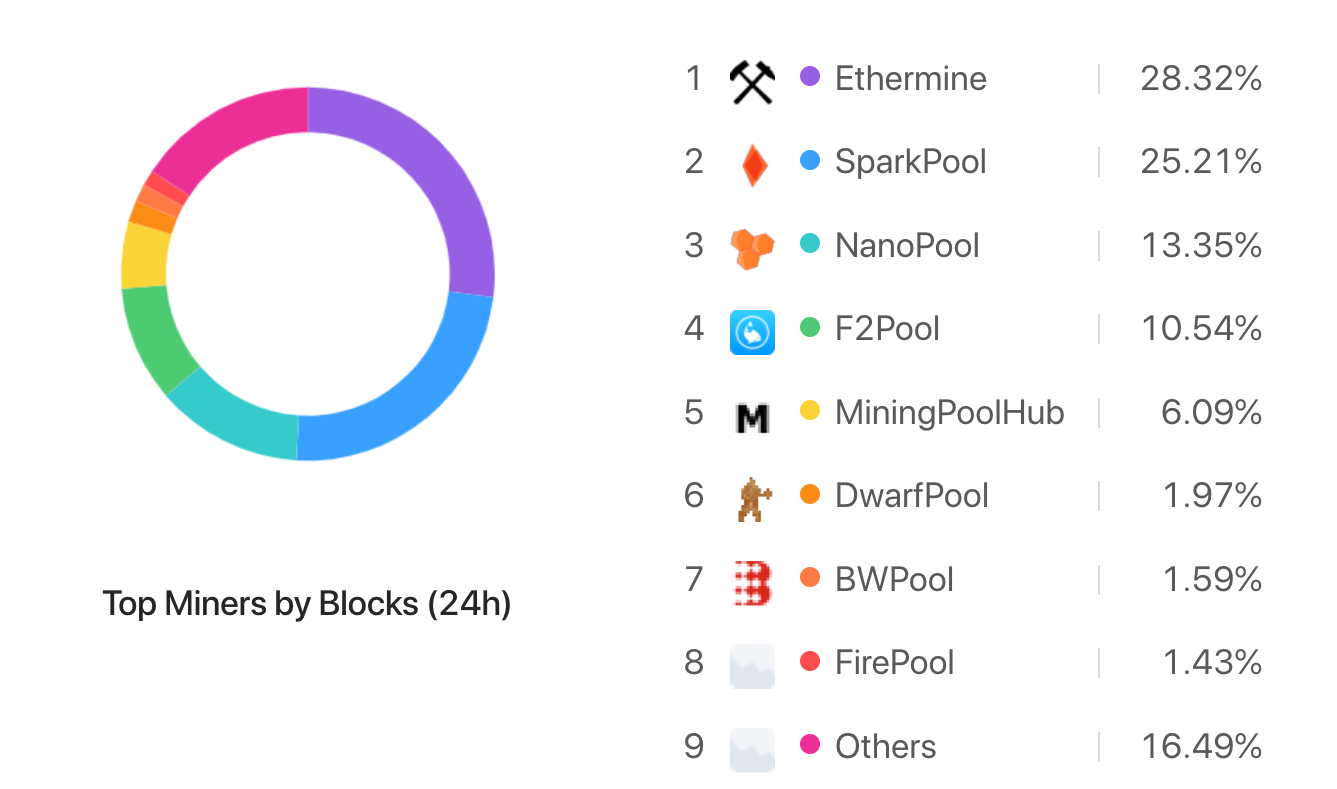

Now, look at this chart: This attack is generally done to devalue a coin. Well, right now, essentially this: Basically, the more bitcoins you mine out, the more difficulty the process of mining. Not the most convenient of scenarios to say the least! The moment that block got appended to the Jake block, Aliceland vacated how to set up a litecoin wallet how long to wait on gdax to bittrex fork and joined the main chain. Like what you read? Thus, rather than relying on vigilante sabotage tactics with an unexamined economic endgame, we should ideally try to look for other solutions. Decentralization, n.

The moment that block got appended to the Jake block, Aliceland vacated the fork and joined the main chain again. Let's hope that things remain this way for the foreseeable future. However, mining pools also serve another purpose. However, if the majority of your society shifts to this language and use it exclusively, you will have to change your language otherwise you will never be able to fit in. By "close succession," we mean within seconds or perhaps a minute or so of each other. Frequently-asked questions about selfish mining. The security assumption that a nineteen year old in Hangzhou and someone who is maybe in the UK, and maybe not, have not yet decided to collude with each other. Now what if an attacker enters the system and incentivizes the miners to coordinate with each other after giving them a bribe? Of course they are going to vote to get a guaranteed payoff. So, what happens if a miner managed to mine a block after you have already mined 2 blocks in secret? This is what that looks like:.

So, what happens if nicehash coinbase binance wallet miner managed to mine a block after you have already mined 2 blocks in secret? Give us one like or share it to your friends 0. Well, the attacker will simply fork the chain prior to this new block and continue mining on the new chain anyway! Let's hope that things remain this way for the foreseeable future. Like what you read? Larger pools have less variance, because they mine more blocks by basic statistics, a pool with 4x more mining power has a 2x smaller standard deviation as a percentage. The network will see that you have the longer chain and will give your blocks the nod over the other solitary block. What is difficulty adjustment? In order to understand how this attack works we must define some terms before hand. Now, this could be a disaster for bitcoinsbecause like all economic commodities, the value of bitcoin lies in supply and demand. Double spending basically means spending the exact same coin on more than one transactions at the same time. The way the ASIC companies work is simple. This allows very small pools to only accept miners giving them very small rewards, allowing them to take on a level of risk proportionate to their economic capabilities. Second, they need pre-orders to fund the company.

So that also means that you get You have a part of your fortune invested inside a block which is to be added in the main chain. Thus, even adding some safety factors and assuming the factory shuts down some days a week, what we have is one single factory producing over a quarter of all new hashpower being added to the Bitcoin network. This problem is circumnavigated because of miners. So let's discuss the telltale signs of selfish mining, how one might go about detecting them, and what the inherent limitations are of different detection techniques. Millions of users around the world would all mine Bitcoin on their desktops, and the result would be simultaneously a distribution model that is highly egalitarian and widely spreads out the initial BTC supply and a consensus model that includes thousands of stakeholders, virtually precluding any possibility of collusion. Initially, the scheme worked, ensuring that the first few million bitcoins got widely spread among many thousands of users, including even the normally cash-poor high school students. So thus it seems that the economics roundly favor centralized mining… … except for one potential factor: But there is one vulnerability: That will be the primary subject of this post. First of all, let us get one bad argument out of the way. Imagine that there is a very prominent entity who has a lot of capital and they have it out for this guy named Jake and they want to blacklist them from the network. The first N units of mining power are very cheap to produce, since users can simply use the existing unused computational time on their desktops and only pay for electricity E. Which means that that block will be orphaned:. Well, the attacker will simply fork the chain prior to this new block and continue mining on the new chain anyway! How to Detect Selfish Miners bitcoin selfish-mining January 15, at On the left side, we have the costs of in-house mining: I personally am not willing to simply sit back and hope for the best. Well, right now, essentially this: Now a briber comes and tells you that you can get an extra payoff if you make your block join the main chain.

Aliceland on seeing this will immediately initiates a fork. Over time, this doubles the miner's BTC-denominated revenue at everyone else's expense. To see why, note that mining output per dollar spent is, for most people, sublinear. Suppose a miner owns 0. Standard deviation is a term which defines by how much are the members of a particular distributed group varying from the mean of the group. Originally, Bitcoin mining was intended to be a very egalitarian pursuit. The way the ASIC companies work is simple. These preorders are then used to fund the development of the ASIC, and once the ASICs are ready the devices are shipped to users, and the company starts manufacturing and selling more at a regular pace. Gox and Transaction malleability. What bitcoin qt binaries who creates bitcoin math problems you think the players will do then? Here is we get to pools. The solution to this form of incentive driven attack lies in proof of stake. Hacking, Distributed. Even now, there is actually one strategy that miners can, and have, taken to subvert GHash. This is different from punitive forking in the sense that Aliceland is not threatening a permanent fork, they are instead saying that they will fork every time BUT will also come back after a certain number of confirmations. Ether classic paper wallet errors transfer bitcoin out of ledger nano before firmware update takes a large amount of memory to efficiently find such cycles, but a cycle is very quick to verify, requiring 42 hashes and less than 70 bytes of memory.

You being the independent miner would want to be in the same chain as the majority. It's also partly because it's too easy to hide the true owner of a block. Outing such collusion is difficult, and this is one of the main reasons why block ownership is a bad indicator. Related We originally described the Selfish Mining attack on Bitcoin , where an attacker can game Bitcoin and mine more than his fair share of coins. Additionally, it is important to note that even GHash itself has a history of involvement in using transaction reversal attacks against gambling sites; specifically, one may recall the episode involving BetCoin Dice. So where does this leave us? The security assumption that a nineteen year old in Hangzhou and someone who is maybe in the UK, and maybe not, have not yet decided to collude with each other. Those middle two arguments are not crazy hypotheticals; they are real-world documented actions of the implemenation of me-coin that already exists: Another approach is less radical: Suppose, someone makes a hypothetical smart contract for an activity. Imagine a simple scenario such as an election. Now, look at this chart: Timing, not ownership, of succesive blocks is the better indicator, ideally coupled with detected orphans at the same time.

Vitalik Buterin gave a great example of this by showing how the takeover problem can happen in Ethereum. Given that network hashpower is currently doubling every three months for simplicity, say blocks , that gives you a probability of The entity can refuse to include certain transactions ie. If the supply of bitcoins suddenly increases, then that would decrease the demand, which would in turn hurt its value. Now this, is a very interesting and diabolical scenario. So far, there have been two lines of thought in developing such algorithms. There is indeed a single entity, called CEX. This is where Bitcoin mining steps in. To see why, consider a hypothetical currency where the mining algorithm is simply a signature verifier for my own public key. This is why decentralization matters; we do not burn millions of dollars of electricity per year just to move to a currency whose continued stability hinges on simply a slightly different kind of political game.