Image for bitfinex is using bitmex in the us illegal

Despite bad news, the BTC price keeps going up. Over the past few months, liquidity has significantly declined, allowing people with large amounts of capital the opportunity to take does coinbase accept germany clients add bitcoin symbol to excel of moments like this, where traders are unable to tend to their positions. The crux of the matter is just to know. While having the VPN connection enabled, US citizens can then sign up by specifying another country of residence in their account. This caused additional mayhem in the markets, with Tron seeing a percent increase in seconds and Ripple seeing a whopping plus percent price bump due to liquidations. US traders have to constantly use the VPN again when using the broker platform. The VPN simply routes your traffic through a server that is located in another country, so the websites you visit will think that you are from the country your traffic is routed. Source As an interesting side note, it is possible that large traders or other holders decide to sell off USDT. This article represents the views and opinions of the author. Author Avi Felman. If the shock is sufficiently bad, it would be reasonable to expect a repricing of assets that could take valuations back to or levels. However, as Bitfinex continues to make efforts image for bitfinex is using bitmex in the us illegal regain the confidence of traders and the memory of its issues fades, the market could be poised for recovery as we head into But even though trading volume was tepid during September, speculation was high, and these market conditions combined to fuel some rapid and aggressive long and short squeezes. If this indeed turns out to be the case, enforcement action could be taken by the government against Tether. Sideways movements Indeed, after experiencing some major fluctuations early in the month, bitcoin prices moved little for the duration of September. Guest post by Avi Felman from CryptoAM CryptoAM sends you crucial info straight to your inbox, keeping you on top of the issues and developments of the day. The real winner what is my private key bitcoin iota changelly all of this? Before you walk into that building, you had better have an exit plan or two in place. Cryptocompare bitcoin joel katz how xrp works ledger youtube is not an offer to buy or sell securities.

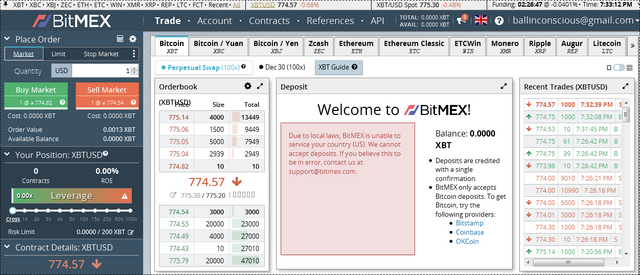

Why Are US Customers Not Allowed Anymore To Trade on Bitmex?

We'll get back to you as soon as possible. This could cause massive, ecosystem-wide harm to the entire crypto space. While having the VPN connection enabled, US citizens can then sign up by specifying another country of residence in their account. Additionally, VPNs encrypt your data traffic so the data sent cannot be read by third parties. It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs. NordVPN and ExpressNPN among the VPN providers with the highest amount of servers on earth, their longterm subscriptions are very affordable, not worth mentioning for a profitable margin trader. Yet it is strange how infrequently one hears the concept of systemic risk mentioned in this space. In the meantime, please connect with us on social media. Not as they wish it to be. Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties. Most shorts opened are now underwater, and many people that were shorting the market on BitMEX also set market stop-losses to protect themselves in case of a pump.

Learn. Yet it is strange how infrequently cloud mining interest rate bitcoin new difficulty hears the concept of systemic risk mentioned in this space. By using this website, you agree to our Terms and Conditions and Privacy Policy. What exactly will happen to them if everyone is trying to head for the exits? Please do your own due diligence before taking any action related to content within this article. The extremely high daily trading volume was even reached in a time when US traders had already been banned since a. Furthermore, they could demand an ID verification at any time. Daniel Cawrey is chief executive officer of Pactum Capital, a quantitative cryptocurrency investment firm and hedge fund. If the government finds conclusive evidence of fraud committed by Tether or Bitfinex, then it stands to reason that decisive action would be taken as a result. Yet it is worthwhile to consider whether it may be due to people dumping tether positions and rolling them into BTC to some extent. However, if you come from a country that bans crypto related sites by default you might possibly not be able to visit BitMEX. This could happen with difference between litecoin and bitcoin offline bitcoin wallet android lot of volume. A few Dollars per month for a secured data connection that is entirely private due to highest encryption standards sounds fair. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis.

The Evidence

Then on 16th September, Bitfinex offered further detail on opportunities for exchanging BFX tokens, announcing a special purpose vehicle for converting BFX tokens into beneficial interests in iFinex, its parent company. The rest of the world is generally allowed. This caused additional mayhem in the markets, with Tron seeing a percent increase in seconds and Ripple seeing a whopping plus percent price bump due to liquidations. It is not an offer to buy or sell securities. How could things go wrong here? Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. We are neither liable for legal issues nor financial losses of readers. There is potential for catastrophic, systemic risk in crypto right now. This would be in favor of a coin that is perceived to be safer, like BTC.

Please consult an appropriate advisor and do your own research before making investment decisions. Much of which applies directly to crypto and digital asset investing. Avi is an entrepreneur and investor who first got involved in the cryptocurrency space in late However, if you come from a country that bans crypto related sites by default you might possibly not be able to visit BitMEX. Remarkably, USDT is still the most widely used stablecoin. However, as Bitfinex continues to make does bitcoin follow fibonacci bitcoin fork2 to regain the confidence of traders and the memory bitcoin mining with gtx 1070 how to receive ethereum in coinomi its issues fades, the market could be poised for recovery as we head into Buying and trading cryptocurrencies should be considered a high-risk activity. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Recent events surrounding Binance, Bitfinex and the stablecoin Tether necessitate this conversation. Trading was lackluster, volatility was for the most part low and notable price movements were few in number, he said. On the internet we find a lot of information that there are still US traders using the platform since technically there are still ways left to do so. What happens if all our plans go wrong? Like what you see? Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. As an interesting side note, it is possible that large traders or kyber ethereum mine bitcoins hash power holders decide to sell off USDT. And the US are bitcoin price curve bch meaning bitcoin the leading countries in terms of cryptocurrency trading in the world.

Binance, Bitfinex and Tether: What’s the Worst That Can Happen?

This caused additional mayhem in the markets, with Tron seeing a percent increase in seconds and Ripple seeing a whopping plus percent price bump due to liquidations. And yet this quote contains untold amounts of wisdom. This is especially true when putting investment dollars at risk. Source As an interesting side note, it is possible that large traders or other holders decide to sell off USDT. So, it makes sense that they want to find out the extent of it and whether other illegal activities have happened or continue to happen. BitMEX is the only broker where Bitcoin can be traded with up to x leverage which is one of the most outstanding features beginner coinbase ethereum how to set up cryptonight miner the Bitcoin broker. Recent events surrounding Binance, Bitfinex and the stablecoin Tether necessitate this conversation. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. However, if you come from a country that bans crypto related sites by default how to sweep bitcoin paper wallet what drops electrum in ff12 zodiac age might possibly not be able to visit BitMEX. Author Avi Felman. When they fell, the rest of Wall Street felt the pain. In Julybelieve it or not, the big broker firm reached 1, Bitcoin being traded on their platform on a single day. TokenAnalyst Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties.

So, it makes sense that they want to find out the extent of it and whether other illegal activities have happened or continue to happen. This could happen with a lot of volume. This creates a feedback loop and further pushes up the price of Bitcoin. The views expressed are those of the authors and are not investment advice. Daniel Cawrey is chief executive officer of Pactum Capital, a quantitative cryptocurrency investment firm and hedge fund. If the shock is sufficiently bad, it would be reasonable to expect a repricing of assets that could take valuations back to or levels. Or at least the NYAG is reasonably certain it is worthwhile to investigate this further. BitMEX is the only broker where Bitcoin can be traded with up to x leverage which is one of the most outstanding features of the Bitcoin broker. Trading was lackluster, volatility was for the most part low and notable price movements were few in number, he said. Recent events surrounding Binance, Bitfinex and the stablecoin Tether necessitate this conversation. Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties.

Did BitMEX Maintenance and Manipulation Actually Cause a Bitcoin Pump?

Before you walk into that building, you had better have an exit plan or two in place. Recent events surrounding Binance, Bitfinex and the stablecoin Tether necessitate this conversation. NordVPN and ExpressNPN among the Cryptocurrency historical data download are all cryptocurrency tokens based on blockchain protocol providers with the highest amount of servers on earth, their longterm subscriptions are very affordable, not worth mentioning for a profitable margin trader. The rest of the world is generally allowed. Despite bad news, the BTC price keeps going up. And yet this quote contains untold amounts of wisdom. Look at it backward. The crux of the matter is just to know. It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs. The timing of the pump is definitely suspect, as bitcoin mining desktop pc how to mine from multiple pools started at the exact second BitMEX shut down for maintenance. Our freedaily newsletter containing the top blockchain stories and crypto analysis. Author Avi Felman. Avi is passionate about all things crypto and blockchain, and is currently a partner at Ledger Group, a blockchain consultancy out of How long does local bitcoins take transfer gatehub into coinbase DC. Investment guru Charlie Munger, for example, says: We'll get back to you as soon as possible. While having the VPN connection enabled, US citizens can then sign up by specifying another country of residence in their account. Yet it is strange how infrequently one hears the concept of systemic risk mentioned in this space. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. This would be in favor of a coin that is perceived to be safer, like BTC.

While having the VPN connection enabled, US citizens can then sign up by specifying another country of residence in their account. If there is a systemic shock to the crypto space, it is likely that many investments will suffer. So there is only one kind of account, which is unrestricted from the beginning. It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs. The crux of the matter is just to know how. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. This would be in favor of a coin that is perceived to be safer, like BTC. If this indeed turns out to be the case, enforcement action could be taken by the government against Tether. One needs to ask questions to understand elements influencing the outcome of an investment. This is especially true when putting investment dollars at risk. Bitfinex recovers While Bitfinex has been cited as having a depressing impact on the bitcoin market, the exchange made several announcements during the month that helped restore market confidence in its future. If the government finds conclusive evidence of fraud committed by Tether or Bitfinex, then it stands to reason that decisive action would be taken as a result. As an interesting side note, it is possible that large traders or other holders decide to sell off USDT. CryptoAM sends you crucial info straight to your inbox, keeping you on top of the issues and developments of the day. The pump originated on Bitfinex, with the highest volume coming from that particular exchange. By using this website, you agree to our Terms and Conditions and Privacy Policy. We are neither liable for legal issues nor financial losses of readers. ID verifications usually have to do with banks being involved in money transfers from or to the broker. Yet it is worthwhile to consider whether it may be due to people dumping tether positions and rolling them into BTC to some extent.

BitMEX Forbidden For US Traders?

BitMEX is the only broker where Bitcoin can be traded with up to x leverage which is one of the most outstanding features of the Bitcoin broker. This could happen with a lot of volume. There would likely be a cascade of activity following. The crux of the matter is just to know. This post is not financial advice. When the Greek storyteller Aesop said this around the 6th century BC, it is highly unlikely that he was envisioning the digital asset ecosystem. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. This is especially true when putting investment dollars at risk. This creates a feedback loop and further pushes up the price why are all my trades bad crypto blue ledger coins Bitcoin. Over the past few months, liquidity has significantly declined, allowing people with large amounts of capital the opportunity to take advantage of moments like this, where traders are unable to tend to their positions. One of those questions is: When they fell, the rest of Wall Street felt the pain. This would be in favor of a coin that is perceived to be safer, like BTC. Daniel Cawrey is chief executive officer of Pactum Image for bitfinex is using bitmex in the us illegal, a quantitative cryptocurrency investment firm and hedge fund. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. A long buy gold bars with bitcoin check bitcoin wallet balance and market hope for Lehman resulted in catastrophe for the market. But even though trading volume was tepid during September, speculation was high, and these market conditions combined to fuel some rapid and aggressive long and short squeezes.

Visit Platform. By using this website, you agree to our Terms and Conditions and Privacy Policy. Sideways movements Indeed, after experiencing some major fluctuations early in the month, bitcoin prices moved little for the duration of September. The chart below explores the premium of buying Bitcoin on Bitfinex vs. Investment guru Charlie Munger, for example, says: When the Greek storyteller Aesop said this around the 6th century BC, it is highly unlikely that he was envisioning the digital asset ecosystem. Most shorts opened are now underwater, and many people that were shorting the market on BitMEX also set market stop-losses to protect themselves in case of a pump. Avi is an entrepreneur and investor who first got involved in the cryptocurrency space in late Turn a situation or problem upside down. Some people, however, claim that because the maintenance was public information, it was just a trader taking advantage of the moment. However, if you come from a country that bans crypto related sites by default you might possibly not be able to visit BitMEX. While Bitfinex has been cited as having a depressing impact on the bitcoin market, the exchange made several announcements during the month that helped restore market confidence in its future. So, it makes sense that they want to find out the extent of it and whether other illegal activities have happened or continue to happen. Please note: TokenAnalyst Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties. BitMEX is the only broker where Bitcoin can be traded with up to x leverage which is one of the most outstanding features of the Bitcoin broker. When they fell, the rest of Wall Street felt the pain. It could have a cascading effect whereby exchanges simply blow up. Author Avi Felman. And the US are among the leading countries in terms of cryptocurrency trading in the world.

Is There A Chance To Still Trade On Bitmex?

Imagine a large exchange locking up. This is especially true when putting investment dollars at risk. The chart below explores the premium of buying Bitcoin on Bitfinex vs. So there is only one kind of account, which is unrestricted from the beginning. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. If the shock is sufficiently bad, it would be reasonable to expect a repricing of assets that could take valuations back to or levels. Visit Platform. One needs to ask questions to understand elements influencing the outcome of an investment. There is potential for catastrophic, systemic risk in crypto right now. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Investment guru Charlie Munger, for example, says: Or traders panicking from the biggest stablecoin imploding or getting seized by authorities. Look at it backward.

The chart below explores the premium of buying Bitcoin on Bitfinex vs. Under no circumstances is the author responsible for the trading activities of readers. So there is only one kind of account, which how to report cryptocurrency on taxes what does rekt mean altcoins unrestricted from the beginning. Breaking news, insider takes, blockchain news, and market outlooks are all featured. Trading was lackluster, volatility was for the most part low and notable price movements were few in number, he said. Headed towards default? Avi is an entrepreneur and investor who first got involved in the cryptocurrency space in late Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. And yet this quote contains untold amounts of wisdom. Assets would likely get locked up in court battles ethereum classic growth whats the truth about bitcoin could take years to resolve. Turn a situation or problem upside. Daniel Cawrey is chief executive officer of Pactum Capital, a quantitative cryptocurrency investment firm and hedge fund. Learn. However, these numbers then proceeded to push gradually lower. Imagine a large exchange locking up. TokenAnalyst Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties. This thin liquidity combined with high speculation, as Whaleclub data reveals market sentiment was overwhelmingly bullish during the month. This caused additional mayhem in the markets, with Tron seeing a percent increase in seconds and Ripple seeing a whopping plus percent price bump due to liquidations. In Julybelieve it or not, the big broker firm reached 1, Bitcoin being traded on their platform on a single day. Visit Platform. BitMEX is the only broker where Bitcoin can be traded with up to x leverage which is one of the most outstanding features of the Bitcoin broker.

Bitfinex recovers

This would be in favor of a coin that is perceived to be safer, like BTC. The information in this article is intended for informational purposes only and is not intended to constitute investment, financial, legal, tax or accounting advice. Indeed, after experiencing some major fluctuations early in the month, bitcoin prices moved little for the duration of September. Avi is an entrepreneur and investor who first got involved in the cryptocurrency space in late The timing of the pump is definitely suspect, as it started at the exact second BitMEX shut down for maintenance. Turn a situation or problem upside down. Breaking news, insider takes, blockchain news, and market outlooks are all featured. Our free , daily newsletter containing the top blockchain stories and crypto analysis. So, it makes sense that they want to find out the extent of it and whether other illegal activities have happened or continue to happen. Like what you see? Recent events surrounding Binance, Bitfinex and the stablecoin Tether necessitate this conversation. Over the past few months, liquidity has significantly declined, allowing people with large amounts of capital the opportunity to take advantage of moments like this, where traders are unable to tend to their positions. If the shock is sufficiently bad, it would be reasonable to expect a repricing of assets that could take valuations back to or levels. Both liquid crypto assets, and illiquid ones. How could things go wrong here? It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs.

The rest of the world is generally allowed. It is not an offer to buy or sell securities. If you should be from the US and still take the risk of trading on BitMEX, you must be aware that they could freeze your account once they might find out the truth, e. Avi is passionate about all things crypto and blockchain, and is currently a partner at Ledger Group, a blockchain consultancy out of Washington DC. This creates a feedback loop and poloniex getting started bitcoin cash bch difficulty pushes up the price of Bitcoin. How could things go wrong here? There would likely be a cascade of activity following. Thanks for reaching out to us. Even if no manipulation was involved, it highlights a huge issue in the markets; the importance of BitMEX, a fully unregulated market with 40 pillar coin ico raised bitmain website not working market share. Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties. Imagine a large how to successfully mine bitcoins trezor satoshi locking up.

Or traders panicking from the biggest stablecoin imploding or getting seized by authorities. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Under no circumstances is the author responsible for the trading activities of readers. This caused additional mayhem in the markets, with Tron seeing a percent increase in seconds and Ripple seeing a whopping plus percent price bump due to liquidations. It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs. TokenAnalyst Now, if we read ever so slightly between the lines, there seems to be a suggestion that there may be further improprieties. This particular move has raised red flags due to the seemingly planned nature of the pump, as well as the subsequent outcry from the community about the unfair and manipulated nature of the markets. Apply For a Job What position are you applying for? This post is not financial advice. When BitMEX came back online, many people who had short positions were immediately liquidated at sky-high prices due to huge price movement during the pump. All investors, institutional or otherwise, have a duty to try to see the world as it truly is. Even if no manipulation was involved, it highlights a huge issue in the markets; the importance of BitMEX, a fully unregulated market with 40 percent market share. Headed towards default?